Find the best software for your business

Get personalized software recommendations from expert advisors—free, fast, and tailored to your needs.

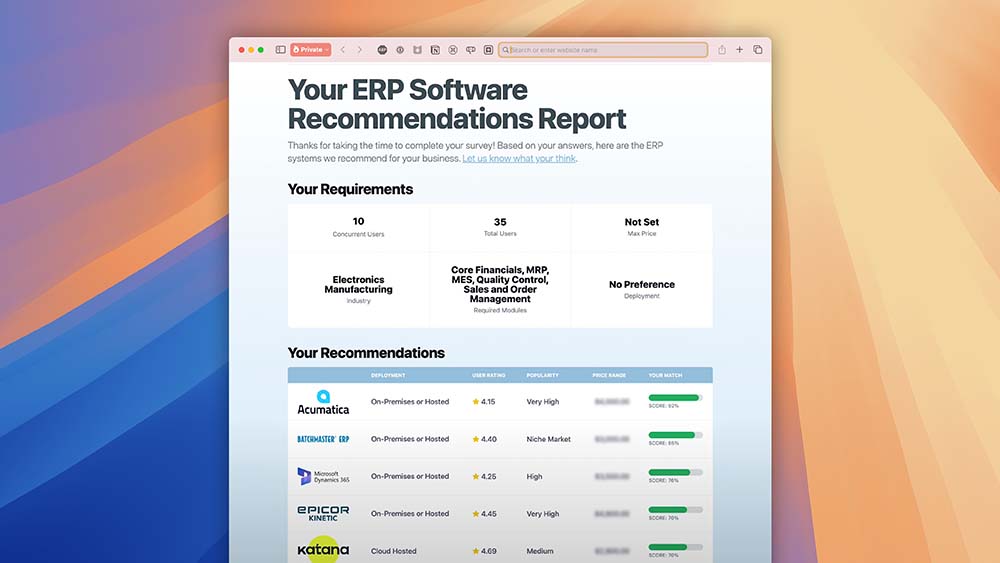

1. Brief Summary. Provide basic information about your business and the goals for your software.

2. Free Consultation. Chat with a software expert who will further clarify requirements and help you though options and price analysis.

3. Get Recommendations. Get customized recommendations that meet your needs along with competitive price quotes from multiple vendors.

Ready to get started? Fill out the form below and we'll review your needs.

Users have given us their honest reviews of the software they use. See what they have to say about the software they use.

Our videos show quick overviews of the software we've tested and reviewed.

We've compiled recommended software lists for a variety of industries and use cases.

It’s less common for enterprise software to perform well and have a good UX. These examples not only perform well, but also have polished, user-friendly interfaces.

We've helped hundreds of thousands of companies find the perfect software for their needs, from the smallest Mom & Pop shops to Fortune 500 companies.

Software Connect has been highlighted in major nationwide newspapers as well as respected industry publications.

We help people find the right software to help manage their business. Every organization handles their processes differently, and software is no different. Some of the best systems on the market are often best optimized for unique use cases.

With over 25 years of helping customers, we’ve built shared scar tissue with dozens of vendors. We know what works and what doesn’t.

Your company’s software stack is an incredibly important part of your business. You should always do your own research.

That said, we can help save you from a ridiculous amount of time waste and headaches. Over the years, we’ve found that:

Which is why we’ve seen so much success with our service. You get free access to our learned expertise. We already know what works and what doesn’t.

We listen to you. We talk with dozens of organizations every week and see implementations across thousands of companies. They know which software actually works well for businesses like yours, common implementation pitfalls, and realistic pricing.

Yes, completely free. Some software vendors pay us annual membership fees to be part of our network, but we’ll recommend systems regardless of their membership status. Membership fees help keep us more independent and less biased than traditional software review websites who rely on affiliate commissions.

Our initial consultations typically take about 5-15 minutes. Most clients get their recommendations within one business day.

We cover virtually every business software category - ERP, CRM, project management, accounting, HR, construction management, manufacturing, retail POS, and hundreds of others.

No obligation whatsoever. If our recommendations don’t fit, you simply don’t move forward. About 30% of our consultations end with “thanks, but not right now’ and that’s perfectly fine with us.

You can call us at (800) 827-1151 or pick a time on our calendar for a scheduled call.